richmond property tax rate 2021

Property taxes are due once a year in richmond on the first business day of july. Province of BCs Tax Deferment.

Lower Mainland 2022 Property Assessments In The Mail

One mill equals 1 of property taxes for every 1000 of assessed valuation.

. View and print Information about Property Tax PDF in Richmond County. Richmond County currently performs a General Reassessment every four 4 to five 5 years. In Person at the counter Property Tax Payment Fees.

Ad Find The Richmond Property Tax Records You Need In Minutes. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. The rates for 2020 were real property set at 1772.

The real estate tax rate is 120 per 100 of the properties. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. Tax rate information for property owners in Richmond Hill including how property taxes are calculated what are tax ratios and why property taxes increase.

Additional Rates for Special Areas All Classes. 2021 property tax bills were due as of November 15 2021. Overall there is a slight increase in real and personal property tax rate but.

The real estate tax rate is 120 per 100 of the properties. It is estimated that by freezing the rate the city will provide Richmonders more than 8. Depending on your vehicles value you may save up to 150 more because the city is freezing the rate.

Due Dates and Penalties for Property Tax. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered. Taxes are based on the assessed value of land and buildings.

Real Estate Property Cards. Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February. Effective date of last General Reassessment.

Personal property at 29830 and motor vehicle at 13. The City of Richmond is not accepting property tax payments in cash until March 31 2021 due to pandemic safety measures. Manage Your Tax Account.

Property Taxes Due. These agencies provide their required tax rates and the City collects the taxes on their behalf. A mill is one tenth of 001 or 1 per 1000 of assessed value.

2021 Tax Rates for Entities Collected for by Fort Bend County Tax Office PDF Frequently Asked Questions PDF Taxpayers Rights. 2 1000 of assmt value between 3M to. The city of richmond is not.

The tax rate is set annually around September 1st based on the assessment as of April 1st of that year and tax bills are sent to the. Millage rates are set by the authorities of each. Understanding Your Tax Bill.

We have done our best to provide links to information regarding the County and the many services it provides to its. For information and inquiries regarding amounts levied by other taxing authorities. Drop Box at City Hall.

In Person at City Hall. Paying Your Property Taxes. Regional Sewer Debt General Land Only Areas A B C 004354 Rates.

The City Assessor determines the FMV of over 70000 real property parcels each year. Property tax payments may be paid by cheque bank draft debit. Online Credit Card Payment Service Fees Apply Pay property taxes and utilities by credit card through the Citys website.

Such As Deeds Liens Property Tax More. Welcome to the official Richmond County VA Local Government Website.

Real Estate Tax Exemption Virginia Department Of Veterans Services

Richmond Heights School District To Consider Replacing Property Tax Funding With An Income Tax Specifically Earmarked For Schools Cleveland Com

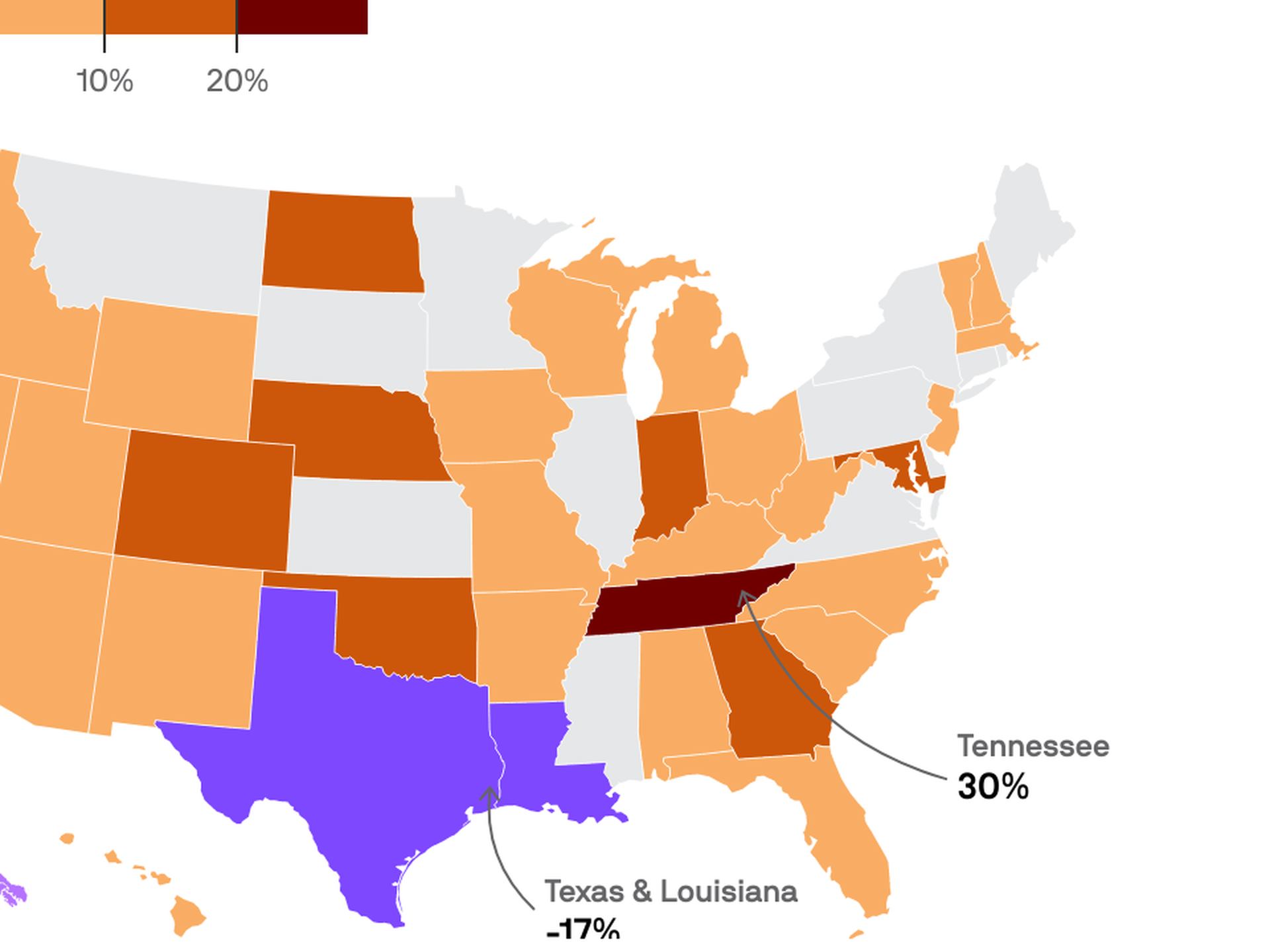

Property Taxes Lagged In 2021 Even As Real Estate Prices Soared

Richmond Property Tax How Does It Compare To Other Major Cities

Property Tax Billings City Of Richmond Hill

A Reminder That If You Richmond Ri Town Government Facebook

Virginia Property Tax Calculator Smartasset

Proposals To Cut Richmond S Real Estate Tax Rate Move Forward Without Recommendations Wric Abc 8news

Scotland County Lowers Property Tax Rate But It S Still The Highest In North Carolina Border Belt Independent

Property Tax Rates In Fulshear Tx Jo Co Not Just Your Realtor

Property Taxes By State How High Are Property Taxes In Your State

Tax Extension Mchenry County Il

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

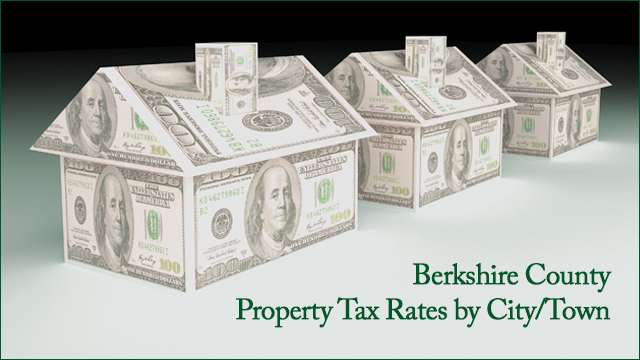

Property Tax Rates Berkshirerealtors

Finance Taxes Augusta Economic Development Authority

Millage Rates Richmond County Tax Commissioners Ga